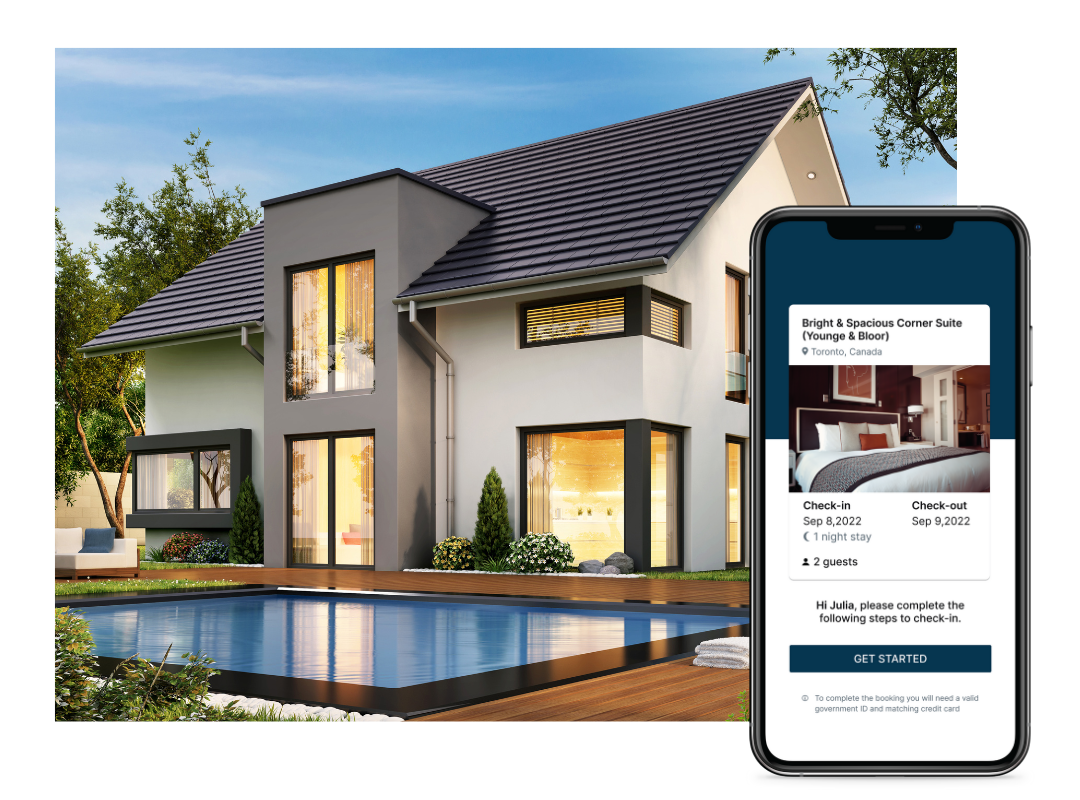

The concept of home-sharing has seen a rapid transformation in recent years, turning residential properties into promising income streams. With this emerging trend, however, come a set of unique risks and potential liabilities. This is where renters insurance plays a pivotal role. Despite being often overlooked, renters insurance is vital to Airbnb hosts, offering protection against unforeseen incidents and safeguarding their investments.

Unpacking Renters Insurance: A Basic Overview

Renters insurance is designed to cover unexpected losses that might be incurred by tenants or property owners. Standard renters insurance policies usually include three types of coverage: personal property, liability, and additional living expenses.

Personal property coverage pertains to damages or losses to personal belongings within the property, while liability coverage takes care of any legal or medical expenses that could arise if a guest gets injured on the property. Additional living expenses, on the other hand, cover any unexpected costs that might arise if the property becomes uninhabitable due to a covered incident.

Does Airbnb cover insurance?

Airbnb’s Host Guarantee Program, offering coverage up to $1 million for property damage, often lulls hosts into a false sense of security. However, it’s essential to recognize that this guarantee is not a comprehensive insurance policy.

For instance, it doesn’t cover liability issues, cash and securities, pets, or shared or communal areas. Moreover, it only comes into effect after exhausting other potential recovery avenues, such as security deposits or the guest’s insurance.

The Imperative Need for Renters Insurance

An in-depth understanding of the limitations of Airbnb’s Host Guarantee Program reveals the irrefutable necessity of renters insurance.

Liability Coverage: The Protective Shield

Renters insurance is particularly crucial for its liability coverage. As an Airbnb host, you open up your property to strangers who might incur accidents or injuries during their stay. Without the right insurance, any ensuing medical or legal expenses could spell financial disaster. Therefore, liability coverage provided by renters insurance serves as a protective shield for hosts against potential legal woes.

Safeguarding Personal Property

While Airbnb’s Host Guarantee may cover damages to the property’s structure, it doesn’t extend to personal property. Renters insurance fills this gap, offering coverage for your belongings within the rented space.

The importance of insurance can be a topic within training materials for empowering front desk staff.

Additional Living Expenses

Suppose a mishap renders the property uninhabitable—think fire, flooding, or significant damage by a guest. In that case, renters insurance can cover additional living expenses during the repair period, minimizing the impact on the host’s income stream.

Renters Insurance Considerations for Hosts

Before securing a renters insurance policy, hosts should evaluate several key factors to ensure they acquire the appropriate level of protection.

Insurance Compatibility

Not all insurance providers support home-sharing or short-term rental scenarios. It is vital for hosts to verify that their intended use of the property as an Airbnb rental is not in breach of their policy terms.

Policy Coverage Limit

The coverage limit is the maximum amount an insurance company will pay towards a covered claim. Hosts should assess their properties and belongings’ worth to ensure their policy’s coverage limit aligns with potential losses.

Coverage Deductible

The deductible is the amount a policyholder pays out of pocket for a covered claim before the insurance benefits kick in. Hosts should balance the deductible against premium costs and their financial capacity to absorb this cost in the event of a claim.

Enhancing Protection with Commercial Insurance

For hosts whose primary business is home-sharing or who rent out entire properties frequently, commercial insurance may be a beneficial addition. Such insurance policies are designed for business activities and may offer more comprehensive coverage than a standard renters insurance policy.

The importance of renters insurance for hosts plays into embracing future digital innovations in hospitality.

What insurance do I need for Airbnb?

As an Airbnb host, it is essential to have a combination of insurance policies for comprehensive protection. Firstly, Airbnb’s Host Guarantee provides a certain level of coverage for property damage. However, it is not a substitute for a robust insurance policy. Hence, hosts should also have homeowners or renters insurance for personal property protection and liability coverage.

If the property is frequently rented out or used primarily for home-sharing, hosts should consider commercial insurance. Lastly, checking with the insurance provider to ensure the policy terms allow for short-term rentals is crucial to prevent potential policy violations. In sum, a well-rounded approach to insurance can help mitigate the risks associated with hosting on Airbnb.

What does renters insurance not cover?

Renters insurance is an excellent way to provide some peace of mind for property owners. However, it’s also crucial to understand its limitations. Here is a list of things typically not covered by renters insurance.

Natural Disasters:

Some catastrophic events like earthquakes, floods, or landslides may not be covered. For protection against these types of events, you may need to purchase additional, specialized policies.

Intentional Damage:

If damage to the property is done intentionally, either by the policyholder or a guest, it’s typically not covered.

Personal Property of High Value:

Luxury items such as fine art, high-end electronics, or expensive jewelry may exceed the coverage limit for personal property and may require additional coverage.

Business Activities:

If a property is primarily used for business purposes, a standard renters insurance policy might not offer sufficient protection. A commercial policy may be needed in these cases.

Pest Infestations:

- Damages caused by pests like rodents or insects are not usually covered.

- Damage from Wear and Tear: Regular maintenance issues or damage caused over time due to regular use are not covered.

Shared Areas:

If the rented property is part of a larger building or complex, shared or communal areas might not be covered by renters insurance. Knowing these limitations can help you make an informed decision when purchasing renters insurance and identify areas where you may need additional coverage.

Conclusion: Prioritizing Renters Insurance for Airbnb Hosting

Renters insurance serves as a vital risk management tool for Airbnb hosts, offering a vital safety net in the dynamic and unpredictable realm of short-term property rental. By comprehending the inherent limitations of Airbnb’s Host Guarantee and identifying the extensive benefits of renters insurance, hosts can safeguard their property, financial security, and business viability.

There is no denying the potential profitability of being an Airbnb host, but it is equally important to acknowledge the associated risks. Investing in the right insurance coverage ensures that hosts can confidently welcome guests, secure in the knowledge that their investment is well protected. After all, the essence of successful business ventures lies in not just maximizing profit, but also efficiently managing potential risks.