Running a successful Airbnb comes with its fair share of challenges, and one of the biggest concerns for property managers is theft.

Protecting your property from potential thieves starts with proactive measures, and understanding the essential steps can help you safeguard your investment. Here, we’ll delve into the importance of guest screening, a secure booking process, and property access control.

Importance of Guest Screening

Guest screening is your first line of defense against theft. By vetting your guests thoroughly, you can significantly reduce the risk of welcoming someone who might have bad intentions. Effective guest screening involves a few key elements.

First, identity verification is crucial. Always ensure that the person booking your property is who they claim to be. Request a government-issued ID and cross-check it with the details provided on the booking platform. This simple step can prevent fraudulent bookings and keep your property safe.

Next, conducting background checks can provide deeper insights into your guests. Look for any red flags such as past criminal records or negative behaviors that could indicate potential problems. While it might seem intrusive, it’s a necessary step in ensuring your property remains secure.

Guest reviews and references also play a significant role in the screening process. Check previous reviews from other hosts to see if the guest has a good track record. If a guest has consistently positive feedback, it’s a good sign they’re trustworthy. Similarly, don’t hesitate to ask for references if the platform doesn’t provide enough information. Reliable guests will understand your need for security and cooperate willingly.

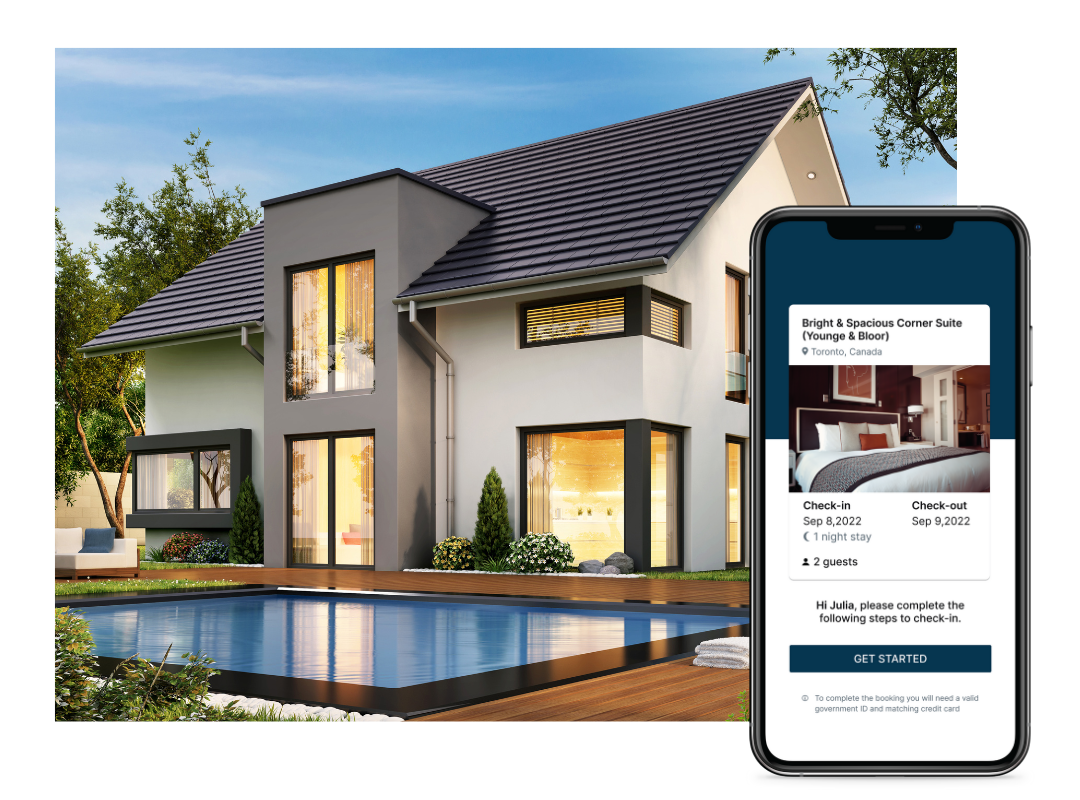

Autohost offers advanced screening tools that simplify these processes. With automated checks and risk assessments, you can identify potentially risky guests before they even step foot on your property. Incorporating such technology into your guest screening routine can save you time and give you peace of mind.

Secure Booking Process

A secure booking process is another crucial element in preventing theft. Start by using reputable booking platforms that offer secure payment systems and fraud protection. These platforms have built-in measures to verify both guests and hosts, adding an extra layer of security.

Communicate directly through the platform’s messaging system. This ensures that all interactions are documented and can be reviewed if any issues arise. Avoid giving out your personal phone number or email address, as this can lead to off-platform transactions that are harder to monitor and secure.

It’s also essential to avoid accepting off-platform payments. While guests might request to pay via bank transfer or cash to save on fees, this is a significant risk. Off-platform payments bypass the security measures of booking platforms, leaving you vulnerable to fraud and making it difficult to trace transactions if something goes wrong.

Implementing these practices can help create a secure environment for both you and your guests. It establishes clear boundaries and ensures all interactions and transactions are transparent and protected.

Property Access Control

Controlling access to your property is fundamental in preventing unauthorized entry and theft. Modern technology offers several solutions to help you manage who can enter your property and when.

Smart locks and keyless entry systems are excellent tools for managing property access. These systems allow you to create unique access codes for each guest, which can be easily changed between stays. This eliminates the risk of lost keys and ensures that previous guests cannot re-enter the property. Plus, you can monitor entry logs to see who enters and exits your property in real-time.

Always change access codes between guests. It might seem like a hassle, but it’s a straightforward way to enhance security. A unique code for each guest ensures that only current occupants have access to the property.

Interior Security Measures

When it comes to preventing theft, securing the inside of your property is just as important as controlling access. Start by removing or locking away any personal items or valuables. As tempting as it might be to leave a few personal touches, anything of significant value should be kept out of reach. Consider installing locked cabinets or closets where you can store these items securely.

Another great way to protect valuables is by providing a safe for guest use. A small, easy-to-use safe can give guests a secure place to store their own valuables, reducing the risk of theft during their stay. Make sure the safe is bolted down or heavy enough that it can’t be easily removed.

Installing security cameras can also be a powerful deterrent. Position cameras in common areas and entrances to monitor activity. Remember, privacy is crucial, so avoid placing cameras inside the house or in private areas like bedrooms and bathrooms. Let guests know that the property is monitored by cameras for their safety and yours. This transparency can make them feel more secure and deter would-be thieves.

Alarm systems are another excellent security measure. Even a basic alarm system can alert you to unauthorized entry. Many modern systems come with smartphone apps that let you monitor your property remotely. This means you can receive alerts and take action immediately if something goes wrong.

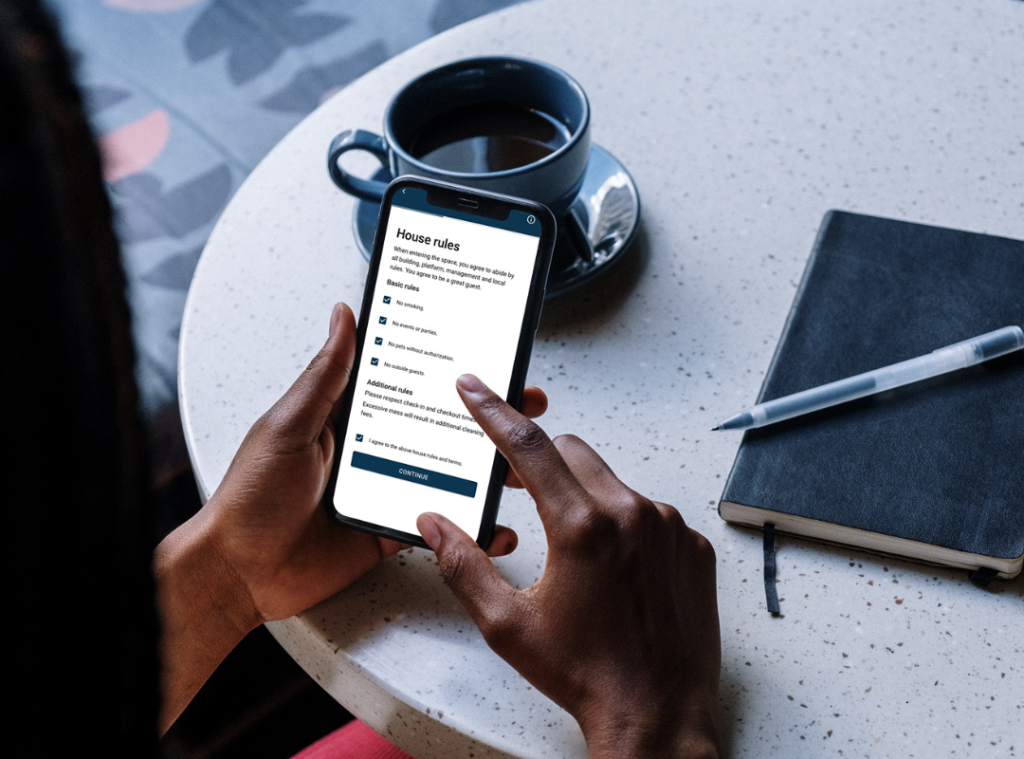

Clear House Rules and Communication

Setting clear house rules and communicating them effectively is another essential step in preventing theft. Your house rules should cover basic security practices, such as locking doors and windows when leaving the property and prohibiting unregistered guests. Clearly stated rules set expectations and help guests understand their role in keeping your property safe.

Include these rules in your listing and reiterate them in your welcome message. A comprehensive house manual is also a great tool. It can provide guests with all the necessary information about your property, including security measures and what to do in case of an emergency. The manual should be easy to read and placed in a visible location.

Effective communication doesn’t stop at the check-in. Stay in touch with your guests throughout their stay. A quick message to check if everything is going well can remind guests of your presence and encourage them to follow the rules. Use friendly language to keep the tone positive and welcoming.

When it comes to security expectations, don’t be shy about being direct. Politely explain why these measures are in place. Most guests will appreciate the effort you’ve put into making their stay safe and will be more likely to comply.

Insurance and Legal Considerations

Even with the best precautions, theft can still occur. That’s why having comprehensive short-term rental insurance is crucial. Regular homeowner’s insurance often doesn’t cover short-term rentals, so it’s important to get a policy specifically designed for Airbnb properties. Look for coverage that protects against theft, property damage, and liability.

Documenting the condition of your property before and after each guest stay is another key practice. Take detailed photos and notes of each room, including any valuable items. This documentation can be invaluable if you need to file an insurance claim or pursue legal action.

In the unfortunate event that theft does occur, knowing the legal steps to take can help you address the situation effectively. Report the theft to local authorities and provide them with all necessary documentation, including your photos and any communication with the guest. Contact your insurance company as soon as possible to start the claims process.

Consulting with a lawyer who specializes in short-term rentals can also be beneficial. They can provide guidance on your legal options and help you navigate any disputes with guests.

Building Relationships with Guests

Creating a rapport with your guests can be a game-changer in preventing theft. When guests feel a personal connection with their host, they are more likely to respect your property. Start by greeting guests warmly upon arrival, if possible, or send a personalized welcome message. This simple gesture sets a positive tone and can make guests feel valued and respected.

Maintaining regular, friendly communication throughout their stay is also crucial. Check in with a quick message to see if they need anything or if everything is going smoothly. This shows you care about their experience and can deter any thoughts of misbehavior.

Encouraging honest feedback from your guests can also help build a strong relationship. Ask for reviews and respond to them graciously, whether they are positive or constructive. This not only improves your service but also shows future guests that you are attentive and engaged.

Fostering these relationships doesn’t mean compromising professionalism. Keep interactions polite and professional, and avoid getting too personal. Striking the right balance ensures guests feel comfortable and respected, without crossing boundaries.

Preventing theft in your Airbnb requires a proactive approach. By focusing on guest screening, securing the booking process, managing property access, enhancing interior security, setting clear house rules, and understanding insurance and legal steps, you can significantly reduce the risk of theft and create a safe, welcoming environment for your guests.