Payments

Reduce Chargebacks with Integrated Verification

Enhance your payment platform with embedded ID verification and fraud detection that reduces merchant chargebacks, ensures compliance, and creates new revenue streams.

Enhance your payment platform with embedded ID verification and fraud detection that reduces merchant chargebacks, ensures compliance, and creates new revenue streams.

Provide merchants with bulletproof evidence to fight disputes and prevent fraudulent transactions before they happen.

Offer seamless KYC/ID verification as a value-added service directly within your payment or onboarding flows.

Go beyond basic payment checks with hospitality-specific fraud detection leveraging network effects and behavioral analysis.

Chargebacks are a major pain point for your hospitality merchants. Equip them with the evidence they need to fight back:

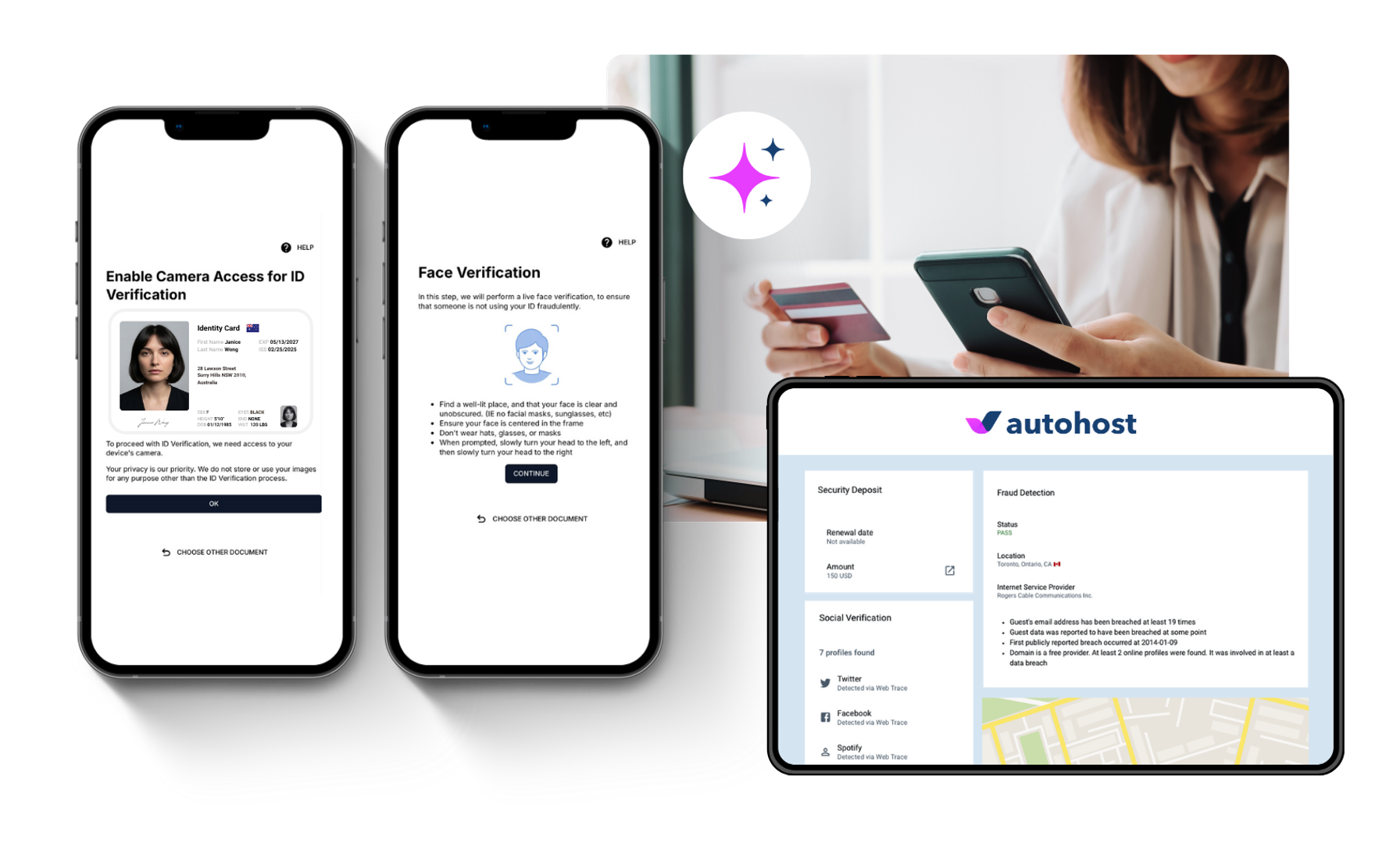

Comprehensive Verification Trail: Capture ID verification, biometric selfies, liveness checks, payment validation, and fraud signals in one place.

Compelling Dispute Evidence: Provide merchants with downloadable reports containing timestamped verification data that overwhelmingly wins disputes.

Reduced Friendly Fraud: Deter opportunistic chargebacks by demonstrating robust guest verification was performed.

Proactive Prevention: Identify and block high-risk transactions before they even become chargebacks, reducing overall dispute volume.

Protect Your Merchants, Protect Your Portfolio: By drastically reducing chargebacks (up to 80%), you lower risk across your merchant base and improve retention.

Meet merchant demand for KYC/ID verification with a seamless, value-added solution:

Seamless SDK Integration: Embed ID verification directly into your merchant onboarding or payment flows with just a few lines of code.

White-Label Experience: Offer verification under your own brand, maintaining a consistent user experience that feels native to your platform.

Compliance Ready: Help merchants meet increasing KYC/KYG regulations in the travel and hospitality sectors automatically.

Global Coverage: Verify 2,500+ document types from 140+ countries, supporting merchants with international clientele.

Enhance Your Value Proposition: Transform your payment platform into a comprehensive security solution, increasing platform stickiness and attracting new merchants.

Go beyond basic payment checks with fraud detection specifically designed for travel and hospitality:

Network Effect Protection: Leverage insights from 28.7M+ hospitality verification events to identify repeat fraudsters and emerging patterns.

Behavioral Analysis: Detect suspicious activity like card stuffing, velocity attacks, and unusual location patterns.

Device & Browser Intelligence: Analyze device fingerprints, IP reputation, browser telemetry, and open ports to identify high-risk signals.

Hospitality-Specific Risk Models: Utilize risk assessment calibrated for short-term rentals, identifying risks that generic fraud tools miss.

Reduce Fraud by 90%: Our multi-layered approach identifies and blocks sophisticated fraud attempts unique to the travel industry, protecting your merchants’ revenue.

Transform verification from a merchant cost center into a revenue opportunity for your platform:

Tiered Verification Services: Offer basic payment validation, enhanced ID verification, or comprehensive fraud screening as premium packages.

Value-Based Pricing: Position verification as a premium security feature that justifies higher processing fees or subscription tiers.

Monetize Compliance: Charge for automated KYC/KYG verification that helps merchants meet regulatory requirements effortlessly.

Competitive Differentiation: Attract merchants by offering integrated security solutions that standalone payment processors lack.

Partner for Profit: Our flexible partnership models allow you to bundle, resell, or integrate verification in a way that aligns with your business strategy and creates significant revenue potential.

Partnering with Autohost is straightforward, allowing you to quickly enhance your platform:

Flexible Integration Options: Choose from SDK for seamless embedding, API for backend integration, or data feeds for risk analysis.

Rapid Deployment: Implement verification capabilities in days, not months, accelerating your time-to-market for new security features.

Comprehensive Support: Access detailed documentation, code examples, and dedicated integration support from our expert team.

Scalable Infrastructure: Rely on our enterprise-grade infrastructure that handles high transaction volumes with 99.9% uptime.

Focus on Your Core Business: Let Autohost handle the complexities of verification while you focus on delivering exceptional payment processing and financial services.

Use Autohost to integrate the services you need via Web SDK, RESTful API, or our Hosted Verification Page. Alternatively, you can onboard users via a QR code or a link to the verification form without integrating Autohost at all. Don't worry about interruptions with 99.996% uptime.

Autohost provides comprehensive verification (ID, selfie, liveness, payment validation, fraud checks) that creates strong evidence to contest chargebacks. Our system identifies high-risk transactions before they occur, reducing fraud by 90% and chargebacks by 80%. We boast a 98% success rate in dispute resolution when our evidence is used.

Our flexible SDK allows you to seamlessly embed ID verification into your merchant onboarding, payment processing, or transaction monitoring flows. We offer white-label options so the experience feels native to your platform, enhancing your value proposition.

While standard checks look at BIN and AVS, Autohost analyzes browser fingerprints, IP reputation, behavioral patterns, device telemetry, and leverages a network effect from millions of hospitality transactions to identify sophisticated fraud attempts specific to the travel industry.

Integrating verification reduces risk across your portfolio, lowers merchant churn by addressing their key pain points (chargebacks, fraud), ensures compliance with KYC/KYG regulations, and creates new revenue streams by offering verification as a premium, value-added service.

reduction in merchant chargebacks

decrease in fraudulent bookings

success rate in dispute resolution