Facing the daunting prospect of gathering enough funds for a traditional security deposit often discourages potential renters, creating a significant barrier in the rental market. This challenge underscores the need for innovative solutions like security deposit insurance, a concept that is revolutionising the way landlords and tenants approach rental agreements.

Understanding Security Deposit Insurance

Security deposit insurance emerges as a modern alternative to traditional security deposits, fundamentally altering the initial financial dynamics of renting. Essentially, this form of renters insurance allows to pay a non-refundable fee – a fraction of the usual deposit amount – providing landlords the same protection against damages or unpaid rent. This insurance model not only reduces upfront costs for renters but also offers landlords quicker, more streamlined transactions.

One of the key differences between traditional security deposits and security deposit insurance lies in their financial impact on tenants. Traditional deposits require substantial upfront cash, often equivalent to several months’ rent, which is held by the landlord and subject to potential deductions at the end of the tenancy. In contrast, security deposit insurance involves a smaller, non-refundable premium paid by the tenant, which covers the landlord for the duration of the lease. This shift in financial responsibility and risk management represents a significant departure from conventional rental practices, aiming to benefit both parties in the long term.

Benefits of Security Deposit Insurance for Renters

The introduction of security deposit insurance brings a host of advantages for renters, fundamentally changing their experience in the rental market. One of the most apparent benefits is the drastic reduction in upfront costs. With traditional security deposits, tenants often strain their finances to accumulate a large sum, which remains inaccessible until the end of their lease. Security deposit insurance, on the other hand, requires only a fraction of this amount as a premium, freeing up funds for other essential expenses.

Another significant advantage is the simplification of the moving process. The traditional method of securing a rental property is often time-consuming and complex, involving credit checks, references, and the collection of a substantial deposit. Security deposit insurance streamlines this procedure, enabling quicker move-ins and reducing administrative burdens.

Moreover, renters gain a layer of protection against the unfair withholding of traditional security deposits. Disputes over property damage or cleanliness at the end of a tenancy are common, sometimes leading to partial or complete loss of the deposit for the tenant. Security deposit insurance mitigates this risk, as the insurance company assumes responsibility for assessing and covering any valid claims made by the landlord.

Services like Autohost.ai further enhance the renter’s experience by providing clear information and guidance about security deposit insurance options. By offering insights into the rental process and the benefits of choosing insurance over traditional deposits, platforms like Autohost.ai play a crucial role in educating renters and aiding their decision-making process.

Advantages for Landlords Implementing Security Deposit Insurance

Landlords also reap significant benefits from adopting security deposit insurance. The administrative process of handling traditional security deposits is often cumbersome, involving the collection, holding, and potential return of large sums of money. Security deposit insurance eliminates much of this administrative overhead, simplifying the landlord’s responsibilities and reducing the time spent on financial management.

From a protection standpoint, security deposit insurance can offer more comprehensive coverage than traditional deposits. While standard deposits may limit the landlord’s financial protection to the amount held, insurance policies can cover higher costs associated with property damage or unpaid rent. This enhanced protection is particularly valuable in cases of significant property damage or extended rent default, where the traditional deposit might not fully cover the incurred losses.

Furthermore, by implementing security deposit insurance, landlords can attract a broader pool of potential tenants. The lower upfront costs make rental properties more accessible to a wider range of applicants, including those who might struggle to accumulate a large traditional deposit. This expanded tenant base can lead to reduced vacancy periods and a more diverse tenant community.

Integrating guest screening solutions like Autohost.ai further strengthens the landlord’s position. By vetting potential tenants comprehensively, these platforms ensure a safer and more secure renting experience for both parties. The combination of thorough background checks and the financial security offered by deposit insurance creates a more robust and dependable rental process, benefiting landlords and tenants alike.

Security Deposit Insurance vs. Traditional Security Deposits

The rental landscape is witnessing a paradigm shift with the introduction of security deposit insurance, compelling both renters and landlords to reassess their approaches. This comparison between the innovative insurance model and traditional security deposits highlights the evolving preferences and practices in the rental market.

Traditional security deposits, while familiar, come with their set of drawbacks. Tenants often find themselves financially strained, having to lock away a significant sum for the duration of their lease. This system can also lead to disputes at the end of tenancies, with disagreements over the return amount. On the landlord’s side, managing these deposits requires careful adherence to legal regulations, adding to their administrative burden.

Security deposit insurance, by contrast, alleviates these concerns. Tenants benefit from lower upfront costs and avoid the risk of losing a large deposit at the end of their tenancy. For landlords, the insurance model offers greater coverage potential and reduces the hassle of managing physical deposits. However, it is crucial to note that this model involves non-refundable premiums, meaning tenants do not get back their insurance cost at the end of the lease, unlike traditional deposits.

This comparative analysis demonstrates how security deposit insurance is not just an alternative financial product but a transformative approach to renting. It represents a shift towards a more flexible, financially accessible, and secure rental market. Both tenants and landlords are encouraged to weigh these differences carefully to determine which model aligns best with their needs and preferences.

Implementing Security Deposit Insurance: A Guide for Landlords

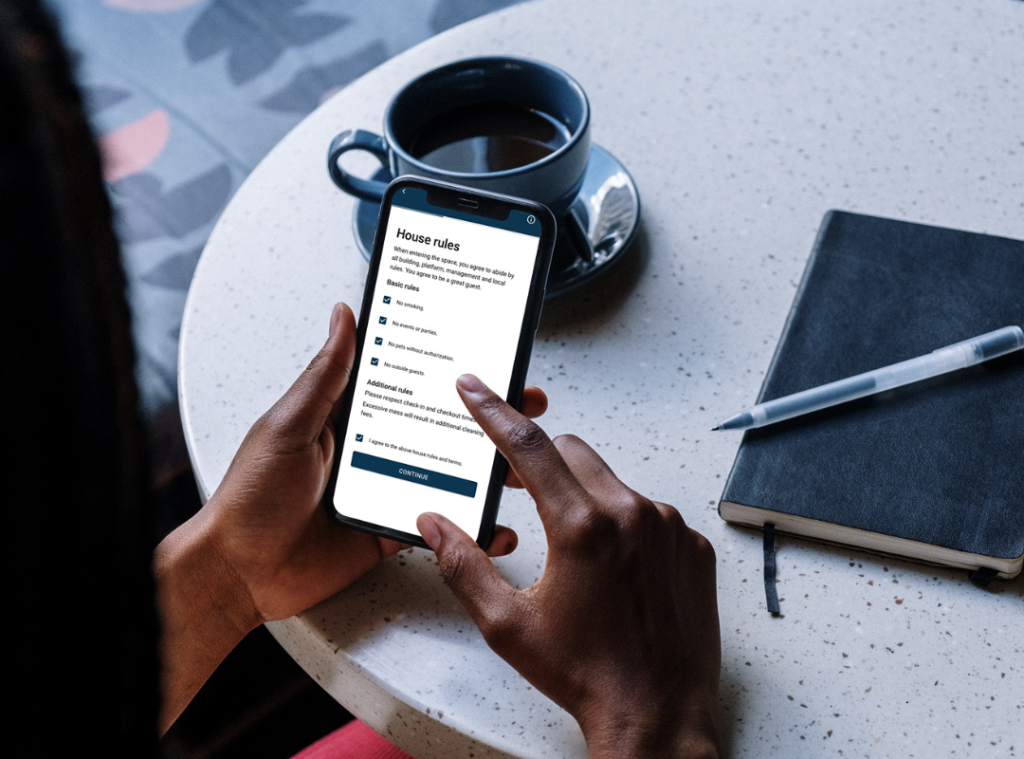

The transition from traditional security deposits to an insurance-based model requires careful consideration and planning. Landlords looking to make this shift must first understand the legal implications and compliance requirements of their region, as rental laws vary widely.

The initial step involves choosing a reputable security deposit insurance provider. Factors to consider include coverage limits, premium costs, claim processes, and customer service quality. It’s also essential to communicate this change effectively to existing and potential tenants, highlighting the benefits and addressing any concerns they might have.

Once a provider is selected, integrating this system into the rental process is the next challenge. This integration should be seamless, ensuring that both the screening of potential tenants and the management of the insurance policy are streamlined. Here, technology plays a crucial role. Platforms like Autohost.ai can be invaluable, offering tools for efficient tenant screening and managing the insurance details. These platforms ensure that the transition to security deposit insurance is smooth, maintaining a high standard of tenant quality while leveraging the benefits of the insurance model.

Landlords must also educate themselves and their staff about the nuances of security deposit insurance. This education ensures that all parties involved can confidently explain the system to potential tenants and address any queries or issues that may arise. Continuous engagement with the insurance provider for updates and support is also a key aspect of successful implementation.

The Future of Rentals: Security Deposit Guarantee and Industry Trends

As the rental industry evolves, security deposit insurance is poised to play a significant role in shaping future trends. The concept of a security deposit guarantee is gaining traction, offering a more inclusive and financially accessible approach to renting. This trend is particularly relevant in urban areas, where the high cost of living and renting challenges the traditional deposit system.

Emerging technologies and platforms are central to this evolution. They not only facilitate the practical aspects of security deposit insurance but also contribute to a broader shift towards digitalization and efficiency in the rental industry. Platforms like Autohost.ai are at the forefront of this change, providing comprehensive solutions that encompass guest screening, insurance management, and data-driven insights.

The growing preference for security deposit insurance reflects a wider trend in the rental market towards flexibility, tenant rights, and financial accessibility. As this trend continues, the industry is likely to see more innovative solutions aimed at enhancing the rental experience for both tenants and landlords. The future of rentals will likely be characterised by these dynamic, tech-driven solutions that prioritise convenience, security, and financial prudence.

Navigating Challenges and Misconceptions

Adopting security deposit insurance is not without its challenges and misconceptions. One common concern among landlords is the perceived lack of control over the deposit and potential difficulties in claim processing. However, reputable insurance providers often have streamlined claim processes, offering support and guidance throughout. It’s crucial for landlords to choose providers with transparent and efficient claim handling to ensure a smooth experience.

For renters, a major misconception lies in the non-refundable nature of insurance premiums. Unlike traditional deposits, these premiums are not returned at the end of the lease. Education is key here – ensuring that renters understand the trade-off between lower upfront costs and the non-refundable nature of insurance premiums is vital for a fair and transparent rental process.

Balancing these challenges and misconceptions requires open communication and education. Platforms like Autohost.ai can assist in this regard, offering resources and support to both renters and landlords to better understand the nuances of security deposit insurance.

Conclusion

As the rental landscape continues to evolve, security deposit insurance emerges as a significant game-changer, offering benefits to both renters and landlords. By reducing upfront costs for tenants and administrative burdens for property owners, this innovative approach is paving the way for a more accessible and efficient rental market. Embracing this model not only aligns with current trends towards flexibility and financial accessibility but also prepares stakeholders for future industry developments.

For those interested in exploring the benefits of security deposit insurance, whether as a renter or a landlord, consider platforms like Autohost.ai as a resource. They offer valuable insights and tools for navigating this new terrain in the rental market. Take the first step towards a more streamlined and equitable rental experience – explore your options, stay informed, and be part of this exciting shift in the industry.