Increasing digitalization of property management and booking processes has contributed to the growth of short-term rentals. Property owners and managers must understand the IRS guidelines for short-term rentals to ensure compliance and maximize their profits. Short-term rentals fall under specific IRS classifications and pay specific taxes, which, if not complied with, can lead to financial and legal complications.

Understanding IRS Short-Term Rental Classification

The IRS defines short-term rentals based on the duration of stay. Generally, a property rented out for less than 30 days at a time is considered a short-term rental. However, this classification can vary based on specific circumstances and local regulations. Understanding this classification is crucial for property owners, as it determines the tax rules and filing requirements applicable to their rental income.

The IRS categorizes rental activities into different segments. If a property is rented for less than 14 days in a calendar year, it is exempt from rental income tax, under what is known as the “Master’s exception,” often associated with major events like the Augusta National Golf Tournament. However, if the property is rented out for more than 14 days, the income must be reported, and the owner is subject to various tax obligations.

A critical aspect of this classification is the distinction between personal and rental use. The IRS scrutinizes the usage pattern of the property. If the owner uses the property for personal purposes for more than 14 days or more than 10% of the total days it is rented to others at a fair rental price, the property is considered a residence. This classification impacts the deductibility of expenses and the method of reporting income and expenses.

The IRS classifies a property as a short-term rental if it’s rented out for less than 30 days at a time. Notably, if you rent out a property for less than 14 days in a year, it’s exempt from rental income tax under the “Master’s exception.”

Navigating Short-Term Rental Tax Requirements

Navigating the tax requirements for short-term rentals can be complex, but understanding these obligations is essential for property owners. The first step in this process is accurately reporting rental income. All income received from the rental must be reported on Schedule E (Form 1040), “Supplemental Income and Loss.” This includes not only the rental payments but also any fees for additional services provided to the tenants, such as cleaning or maintenance services.

In addition to income reporting, short-term rental owners are also required to pay various taxes. These can include federal income tax, state income tax, and local taxes such as occupancy or tourist taxes, depending on the location of the rental property. The rates and requirements for these taxes vary, making it essential for owners to be well-informed about their specific obligations.

Deductions are a critical component of managing tax liabilities for short-term rentals. Owners can deduct ordinary and necessary expenses incurred in renting out the property. These expenses include mortgage interest, property taxes, advertising expenses, maintenance, and utilities. However, it’s important to note that the extent of deductibility can be influenced by how much the property is used for personal versus rental purposes.

Maximizing Deductions and Handling Short-Term Rental Income

The financial management of short-term rentals extends beyond basic income reporting. For property owners, understanding how to handle rental income and maximize deductions is key to optimizing profitability. Short-term rental income encompasses not just the rent payments received but also any additional fees charged to guests, such as cleaning fees or charges for extra amenities. This income should be meticulously documented and reported to the IRS.

Maximizing deductions is an effective strategy to reduce taxable income. Common deductible expenses include mortgage interest, property insurance, property taxes, maintenance costs, utility expenses, and advertising costs. Additionally, expenses directly related to the rental activity, like fees for property management services, including those offered by platforms like Autohost.ai, can also be deductible.

Depreciation is another significant deduction that owners often overlook. This involves deducting the cost of acquiring and improving the rental property over its useful life, as defined by the IRS. Understanding how to calculate and claim depreciation appropriately is vital, as it can considerably lower taxable income.

However, the IRS imposes specific rules on deductions based on the duration of rental use and personal use of the property. If a property is used for both personal and rental purposes, expenses must be apportioned accordingly. Only the portion of expenses attributed to rental use can be deducted. Proper documentation and record-keeping are crucial in substantiating these deductions in case of an IRS audit.

Enhancing Guest Experience and Safety

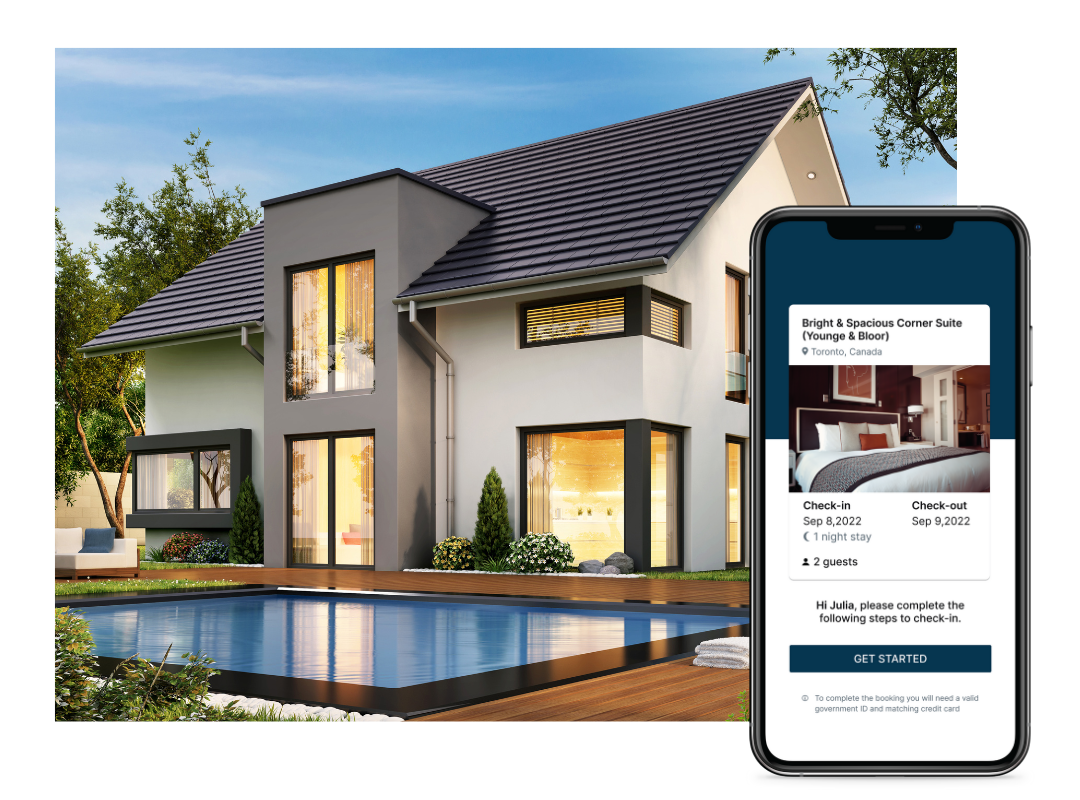

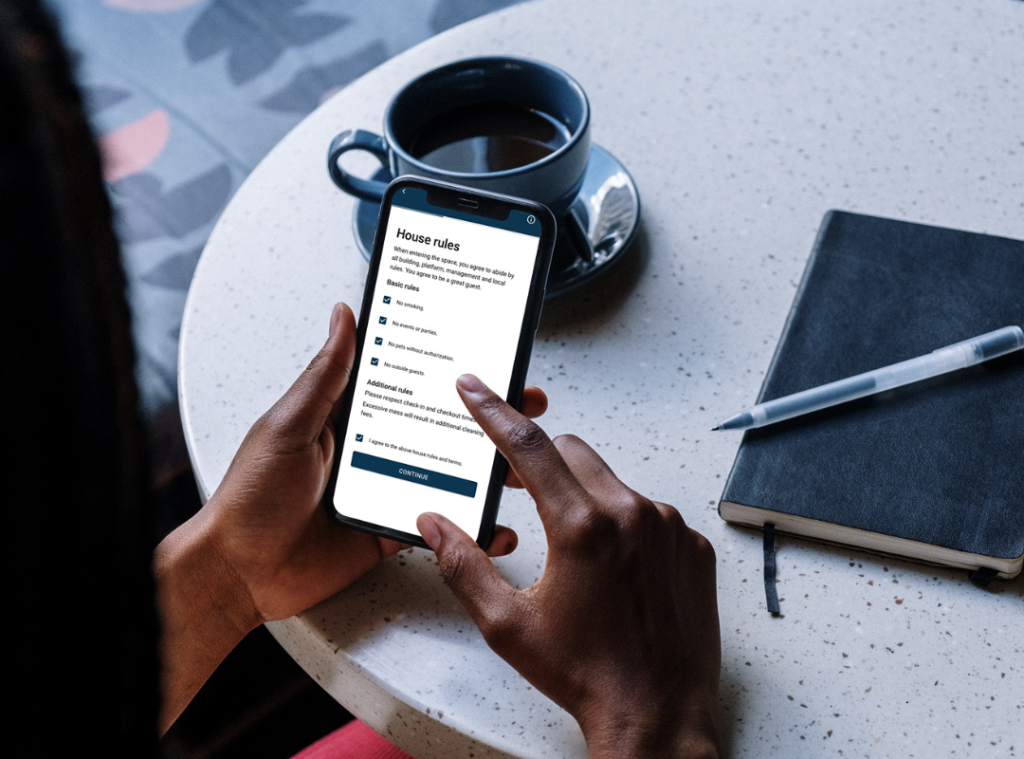

Looking to create a secure environment for your tenants? Verification software provides an effective solution to screen guests and fulfill regulatory requirements, ultimately leading to a more positive experience for renters.

By implementing robust tenant screening software, short-term rental hosts can thoroughly vet guests before confirming a booking. This proactive approach helps mitigate risks, protect property, and foster trust between hosts and their customers.

Guest software enables you to validate guest identities, check criminal histories, and confirm other relevant information. This level of screening safeguards your property and makes a guest’s stay enjoyable. They can feel confident in your commitment to their wellbeing.

Also, many jurisdictions have introduced regulations governing short-term rentals. Guest screening software empowers hosts to comply with these requirements. This demonstrates your commitment to responsible hosting and building a positive reputation within the community.

The Role of a Short-Term Rental CPA

Engaging a Certified Public Accountant (CPA) who specializes in short-term rentals can be invaluable. A short-term rental CPA offers expertise in navigating complex tax regulations specific to rental properties. They provide tailored advice on how to manage rental income, maximize deductions, and ensure compliance with IRS guidelines. An experienced CPA can assist property owners in optimizing their financial strategies, reducing their tax liabilities, and enhancing their profitability. Additionally, a CPA can assist in maintaining accurate records and preparing for potential audits, providing peace of mind and financial security.

The IRS Augusta Rule Explained

A unique aspect of IRS regulations on short-term rentals is the “Augusta Rule.” This rule provides an exception for homeowners who rent out their properties for a short period. Under this rule, if a property is rented for less than 15 days in a calendar year, the income generated from such rental does not need to be reported to the IRS. This exemption can be particularly beneficial during large events or festivals when homeowners can earn significant rental income without increasing their tax liability.

However, while the Augusta Rule exempts income from being reported, it also prohibits the homeowner from deducting any expenses related to the short-term rental. This includes advertising, cleaning, and maintenance expenses directly associated with the rental period. Property owners must weigh the benefits of the tax-free income against the inability to claim related expenses.

This rule demonstrates the IRS’s flexibility in accommodating varying rental scenarios. For homeowners considering short-term rentals as a way to generate additional income, understanding and applying the Augusta Rule can be a significant financial advantage.

Short-Term Rental Tax Loophole: What Owners Should Know

The term “short-term rental tax loophole” often refers to certain aspects of tax laws that can be advantageous for property owners. One such loophole involves the use of the property as a personal residence for part of the year and as a rental for the remainder. If the owner uses the property as a residence for less than the greater of 14 days or 10% of the total days it is rented, the IRS considers it a rental property. This classification allows the owner to deduct rental expenses in excess of rental income, which can offset other income and reduce overall tax liability.

Another strategy involves structuring the rental activity to qualify as a business. If an owner actively participates in managing the rental and meets certain criteria, the rental activity can be classified as a business, opening up additional deductions, including business travel, office expenses, and depreciation. However, this strategy requires careful documentation and adherence to IRS rules.

While these loopholes can be beneficial, property owners should approach them with caution and ideally seek advice from a tax professional. Misinterpreting tax laws or stretching deductions can lead to audits and penalties. Responsible use of these tax strategies can enhance the profitability of short-term rentals while ensuring compliance with tax regulations.

Understanding Short-Term Rentals Tax Treatment

The tax treatment of short-term rentals involves several unique considerations that property owners must understand to manage their finances effectively. Short-term rentals are subject to different tax rules than long-term rentals, including specific regulations on income reporting, deductible expenses, and the classification of rental activity. Rental income must be reported on Schedule E of Form 1040. Various deductions are available, such as mortgage interest, property taxes, and maintenance costs. However, the extent of these deductions depends on the rental duration and the personal use of the property. Properly navigating these tax treatments ensures compliance and optimizes financial outcomes for short-term rental owners.

Record-Keeping and Documentation Best Practices

Effective record-keeping is vital for short-term rental owners, especially when navigating the intricate tax requirements. Maintaining comprehensive records of all rental-related income and expenses is essential. This includes keeping receipts, invoices, bank statements, and records of electronic transactions.

Documentation should be organized and readily accessible. Digital tools and software like Autohost.ai can be extremely beneficial in this regard. These platforms not only help in managing bookings and guest interactions but also provide features for tracking income and expenses, simplifying the accounting process.

In addition to financial records, owners should keep a detailed log of the days the property was rented out and the days it was used for personal purposes. This log is crucial for determining the property’s tax classification and for apportioning expenses between personal and rental use.

Good record-keeping practices not only prepare owners for tax time but also provide a clear picture of the rental property’s performance. This information is invaluable for making informed decisions about pricing, promotions, and property improvements, ultimately contributing to the success of the rental business.

Navigating Complex Tax Situations in Short-Term Rentals

The realm of short-term rentals can sometimes present complex tax situations that require careful navigation. Scenarios such as renting out multiple properties, dealing with long-term cancellations, or operating in different states or countries can introduce additional tax challenges. In such cases, the tax implications can become intricate, and the regulations more stringent.

For instance, renting out multiple properties might necessitate different tax treatments for each property, depending on how they’re used and rented. Similarly, dealing with cancellations, especially long-term ones, may affect how rental income is reported and what expenses can be deducted. Operating in different jurisdictions adds another layer of complexity, as property owners must comply with the tax laws of each state or country.

In these complex scenarios, it’s often prudent to seek professional tax advice. A tax expert specializing in real estate or short-term rentals can provide invaluable guidance, ensuring compliance with all relevant tax laws and optimizing tax benefits.

Staying Compliant and Maximining Returns

Navigating the IRS short-term rental guidelines is a critical aspect of successful property management. By understanding and adhering to these regulations, property owners can ensure compliance, avoid potential penalties, and optimize their financial returns. The key is to stay informed about the evolving tax laws, maintain meticulous records, and, when necessary, consult with tax professionals.

Partnering with Autohost.ai to Improve the Botton Line

Staying compliant with tax regulations while maximizing your rental income becomes much more manageable with Autohost.ai. As verification software, it empowers you to fulfill your duty of care, verifying identities, screening for red flags, and upholding the standards that guests and authorities expect. This proactive approach translates to happier customers, better reviews, and a thriving short-term rental business.

Ready to elevate your guest screening process? Schedule a demo today and discover how our software can help you protect your property, enhance your reputation, and ensure a positive guest experience.