The hospitality industry is hemorrhaging money to chargebacks at an unprecedented rate. While payment processors boast about fraud detection improvements, the numbers tell a different story: Global chargebacks are projected to grow 24% by 2028, reaching 324 million transactions. For hospitality operators – hotels, short-term rentals, and property managers – this isn’t just a payment processing headache, it’s an existential threat to profitability.

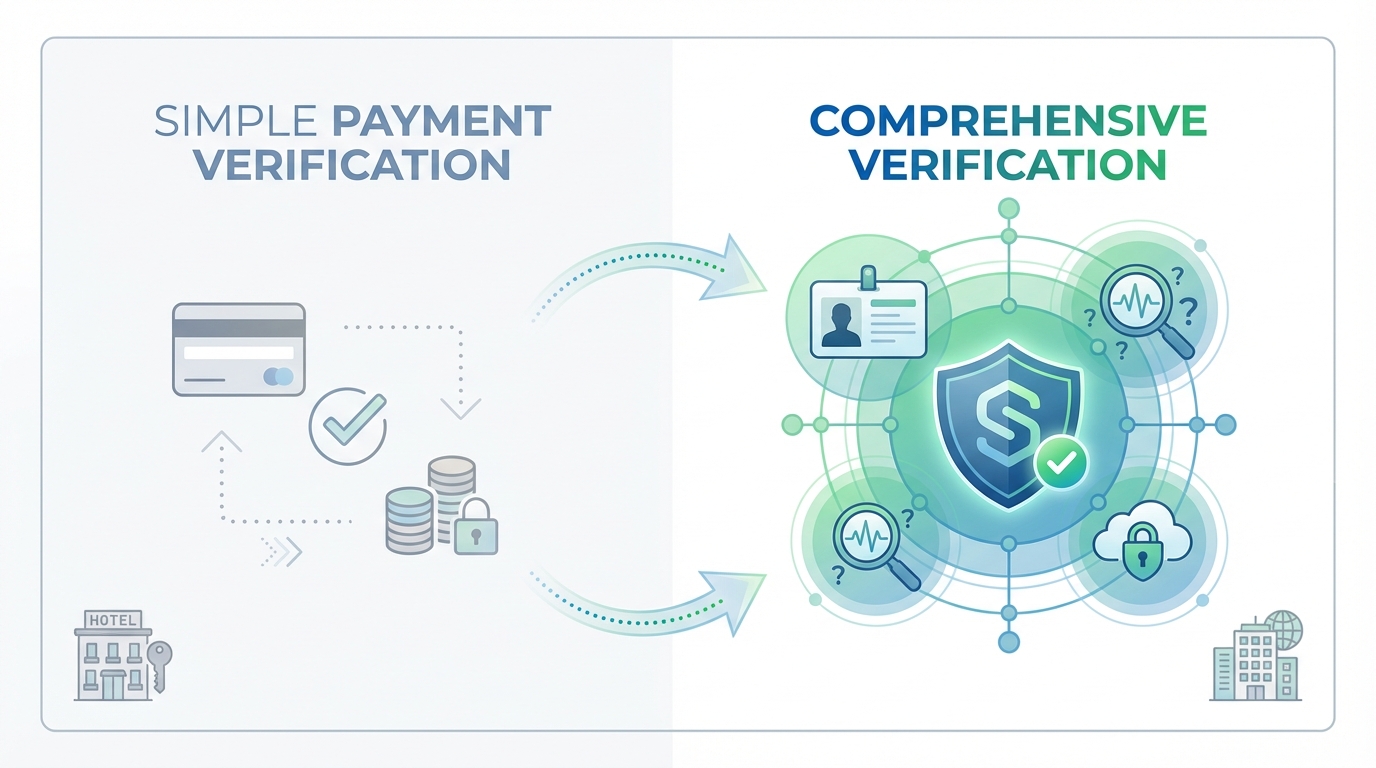

The uncomfortable truth is that traditional fraud prevention is solving the wrong problem. The industry has spent decades perfecting payment verification – ensuring cards are valid, funds are available, and transactions clear smoothly. But fraudsters aren’t using invalid cards anymore. They’re using legitimate payment methods with malicious intent, and current systems can’t tell the difference.

For technology platforms serving the hospitality sector – PMS providers, booking engines, channel managers, and integration partners – this represents both a critical vulnerability in your partners’ operations and a significant opportunity to differentiate. Understanding this shift and building accordingly will make you indispensable. Those that don’t will watch their customers bleed margin to an entirely preventable problem.

The Numbers Don’t Lie – Hospitality’s Chargeback Crisis

Let’s start with the scale of the problem. Hospitality faces the highest average chargeback value of any industry: $120 per transaction. In the travel and hospitality sector, merchants face total costs of $450 per chargeback dispute, representing a 3.75x cost multiplier when you consider fees, lost revenue, and labor.

“Hospitality operators aren’t just losing booking revenue – they’re losing 3.75x that amount. This isn’t a payment problem. It’s a profitability crisis.”

The trajectory is alarming as lodging and travel see continuous chargeback increases. This isn’t a temporary spike – it’s a fundamental shift in how bad actors exploit hospitality businesses. And why is hospitality so uniquely vulnerable? The industry operates in a perfect storm of fraud-enabling conditions:

Card-not-present transactions dominate the landscape. With 63% of merchant transaction volumes now being ‘card-not-present’, hospitality operators lack the fraud protection that comes from physical card verification. Every booking is a remote transaction with inherently higher risk.

High transaction values make hospitality attractive to fraudsters. A hotel stay or vacation rental represents hundreds or thousands of dollars per transaction – significantly more lucrative than most e-commerce fraud targets.

Time lag creates verification challenges. Booking can happen weeks or months before stays. By the time a fraudulent reservation is discovered, the chargeback window is wide open and evidence is stale.

Intangible services are harder to prove. Unlike physical goods with tracking numbers and delivery confirmation, hospitality operators must prove a guest stayed at a property and received the service as described – often relying on documentation that wasn’t systematically collected.

Direct booking growth exposes operators to full liability. As operators push to capture more direct bookings and reduce OTA dependency, they inherit 100% of the fraud risk that OTAs previously (mostly) absorbed as merchant of record.

For tech platforms, this data should be a wake-up call. Your customers – the operators using your systems – are losing significant margin to a problem that payment gateways alone cannot solve.

The Malicious Actor Problem – When “Friendly” Fraud Isn’t Friendly

Not all chargebacks are created equal, and understanding the distinction is critical to building effective prevention strategies.

Between 75-79% of all chargebacks are classified as “friendly fraud” – a misleading term for what is often deliberate theft. These aren’t cases of stolen credit cards or identity theft. These are legitimate cardholders who received the service they paid for, then dispute the charge anyway.

In hospitality, friendly fraud takes predictable forms:

- False claims about property conditions. A guest books a luxury rental, stays the entire reservation, then files a chargeback claiming the property was “uninhabitable” or “not as described.” Without systematic documentation, operators struggle to prove otherwise.

- “Never received service” claims after completed stays. Despite check-in records, communication logs, and even positive reviews, some guests file chargebacks claiming they never stayed at the property. Payment processors often side with cardholders in these disputes.

- Party house chargebacks. Groups book properties for unauthorized events, cause damage, get caught and removed, then file chargebacks claiming they were wrongfully denied service. The property loses the booking revenue, incurs damage costs, and pays chargeback fees.

Beyond friendly fraud lies outright criminal activity:

- Stolen card fraud. Despite payment verification, stolen cards still get through – especially when fraudsters have enough cardholder information to pass basic security checks.

- Synthetic identity fraud. Fraudsters create fake identities using real social security numbers combined with fabricated information. These synthetic identities, when handled in isolation of other factors, can pass credit checks and payment verification while being completely untraceable.

- Professional fraud rings. Organized groups systematically exploit hospitality businesses, booking multiple properties with stolen or synthetic identities, then either never showing up or filing chargebacks after stays.

“The chargeback button has become a refund button with no accountability. For malicious actors, it’s risk-free accommodations.”

The current system creates the wrong incentives. Legitimate guests who have issues typically work directly with operators to resolve problems. Malicious actors skip that step entirely and go straight to their bank, knowing the odds favor them. Merchants, in general, win only 45% of disputed chargebacks, even when they have legitimate grounds to contest (and that’s considering merchants only respond to ~53% of chargebacks, so overall net recovery rate is only 18%)

For tech platforms, this distinction matters enormously. Payment verification catches some criminal fraud, but it’s completely blind to friendly fraud and sophisticated identity manipulation. Your customers need tools that address both categories – and that requires a fundamentally different approach.

The Identity and Intention Gap – Why Traditional Prevention Fails

Here’s what traditional fraud prevention does well: it verifies that a credit card is valid, has available funds, and matches basic billing information. Payment gateways have become remarkably sophisticated at this specific task.

Here’s what it doesn’t do: verify that the person making the booking is who they claim to be, or that they have legitimate intentions for the reservation.

This is the identity and intention gap, and it’s where the vast majority of hospitality chargebacks originate.

Current prevention systems answer one question: Is this payment method valid?

But operators need answers to two entirely different questions:

- WHO is this person really? Not just “does the name match the card,” but “can you prove this is a real person with verifiable identity?”

- WHY are they booking? What signals in their booking behavior, communication patterns, and stated purpose indicate legitimate versus malicious intent?

Payment verification is blind to both questions. Consider how fraudsters exploit this gap:

Stolen cards pass verification. If a fraudster has enough cardholder information – name, address, CVV – the payment clears smoothly. The operator has no indication anything is wrong until the real cardholder notices the charge and files a dispute.

Synthetic identities look legitimate. A fake identity with a real social security number can establish credit history, open bank accounts, and make purchases that pass all standard verification checks. Payment systems see a valid customer. Operators see a booking that will inevitably become a chargeback.

Malicious actors with valid cards have no red flags. The guest planning to trash your property and file a chargeback is using their own credit card. Payment verification sees a legitimate transaction. There’s no fraud signal whatsoever – until it’s too late.

Booking patterns that signal fraud go undetected. Last-minute bookings for local addresses, vague communication about purpose of stay, reluctance to provide identification – these behavioral signals never reach payment processors, so they can’t factor into fraud decisions.

The direct booking trend amplifies this gap dramatically. OTAs operate at massive scale with sophisticated fraud detection systems, dedicated teams, and the financial resources to absorb losses. When operators push for direct bookings – which they absolutely should for margin reasons – they inherit fraud liability without inheriting enterprise-grade fraud prevention tools.

“Payment verification tells you the card works. Identity and intention verification tell you whether you should accept the booking at all.”

For tech platforms, this represents a critical strategic decision point. You can continue offering payment processing integration and leave your customers exposed to this gap, or you can differentiate by addressing the actual problem. This is the time to integrate identity and intention verification capabilities into platforms that want to become stickier, more valuable, and significantly harder to replace.

What Actually Works – The Verification-First Defense

Given that merchants win only 45% of disputed chargebacks, some might say that fighting chargebacks after they occur is a losing strategy. We won’t say that, but we will say that it should be your backup plan, not your primary strategy. The undeniably best approach is prevention – stopping fraudulent bookings before they become reservations.

Effective prevention requires a verification-first approach that addresses both identity and intention:

Identity Verification

Real fraud prevention starts with knowing who is making the booking. This means:

- Government-issued ID verification that checks document authenticity, not just that an ID was uploaded

- Selfie matching to confirm the person booking matches the ID provided

- Document authenticity checks that detect fake or manipulated IDs

- Cross-referencing against fraud databases and watchlists to catch known bad actors

This level of verification plays a significant role in eliminating synthetic identities, stolen identity fraud, and creates accountability that deters friendly fraud. When guests know their real identity is verified and documented, the considerations around filing false chargebacks changes dramatically.

Intention Verification

Beyond identity, operators need to assess booking intent through:

- Booking pattern analysis that flags high-risk indicators (last-minute local bookings, unusual stay durations, suspicious timing)

- Communication quality assessment that identifies vague, evasive, or suspicious responses about purpose of stay

- Purpose of stay verification that ensures the booking aligns with property rules and guest count

- Risk scoring that synthesizes multiple signals into actionable accept/review/decline recommendations

Documentation

When disputes do occur, documentation determines outcomes. Systematic collection of:

- Pre-stay agreements with verified digital signatures

- Photo documentation of property condition before and after stays

- Communication logs showing all guest interactions

- Check-in and check-out verification with timestamps and identity confirmation

This documentation shifts the burden of proof. Instead of operators scrambling to reconstruct what happened, they have comprehensive records that make fraudulent claims nearly impossible to sustain.

Technology Enablement

For this approach to work at scale, it must be automated and integrated:

- Automated workflows that trigger verification steps based on risk levels

- Real-time risk assessment that provides immediate booking decisions

- Seamless integration with booking systems and PMS platforms

- Scalability that works for single properties and large portfolios alike

“The operators winning the chargeback battle aren’t the ones with better lawyers – they’re the ones who never let the fraudster through the door.”

The Direct Booking Dilemma – Why Tech Platforms Must Care

Here’s the tension every hospitality operator faces: direct bookings offer dramatically better margins, but come with full fraud liability as merchant of record.

The math is compelling on the surface:

- OTA bookings: 15-25% commission, but the OTA absorbs (most of the) chargeback risk as merchant of record

- Direct bookings: 0% commission, but 100% fraud exposure falls on the operator

Without effective fraud prevention, those margin gains evaporate quickly. A single chargeback at $120 average value with a 3.75 multiplier costs $450. For a property averaging $200/night, that’s more than two nights of revenue lost to cover one fraudulent booking.

For tech platforms, this creates a critical responsibility and opportunity:

Your customers want direct booking capabilities. Every PMS platform, booking engine, and channel manager is being asked to enable direct bookings. Operators see the commission savings and want to capture that value.

But enabling direct bookings without fraud protection creates liability. You’re essentially handing operators a tool that increases their risk exposure without giving them the means to manage it. When chargebacks spike, operators don’t blame the fraudsters – they question whether direct bookings are worth the risk.

The platforms that integrate robust identity and intention verification make direct bookings genuinely more profitable, not just theoretically better. You’re not just enabling a channel – you’re making it safe to use.

The operators who are thrivng in the direct booking revolution aren’t the ones capturing the most reservations – they’re the ones capturing the right reservations. That distinction requires knowing who is booking and why, before accepting the reservation.

The Verification Imperative

The chargeback epidemic in hospitality isn’t going away. With 324 million chargebacks projected by 2028 and hospitality bearing the highest per-transaction costs, the pressure on operators will only intensify.

For technology platforms serving this industry, the strategic imperative is clear: verification capabilities are no longer optional differentiators – they’re essential infrastructure. Your customers need to know who is booking and why, before accepting reservations. Payment verification alone cannot answer those questions.

The platforms that integrate robust identity and intention verification will enable their customers to capture the margin benefits of direct bookings without the fraud exposure. Those that don’t will watch their customers either lose profitability to chargebacks or migrate to platforms that solve the problem.

This isn’t about adding a feature. It’s about understanding that the fundamental challenge in hospitality fraud has shifted from payment validation to identity and intention verification. The technology exists. The ROI is proven. The operators who will thrive aren’t the ones with the most bookings – they’re the ones with the right bookings. That starts with knowing who’s on the other side of every reservation.